- New light commercial vehicle registrations fall -11.8% in May, the sixth monthly decline in a row.

- Electric van uptake grows 50.0% but market share still just half of mandated levels.

- Industry urges government to back market regulation with equally bold infrastructure targets.

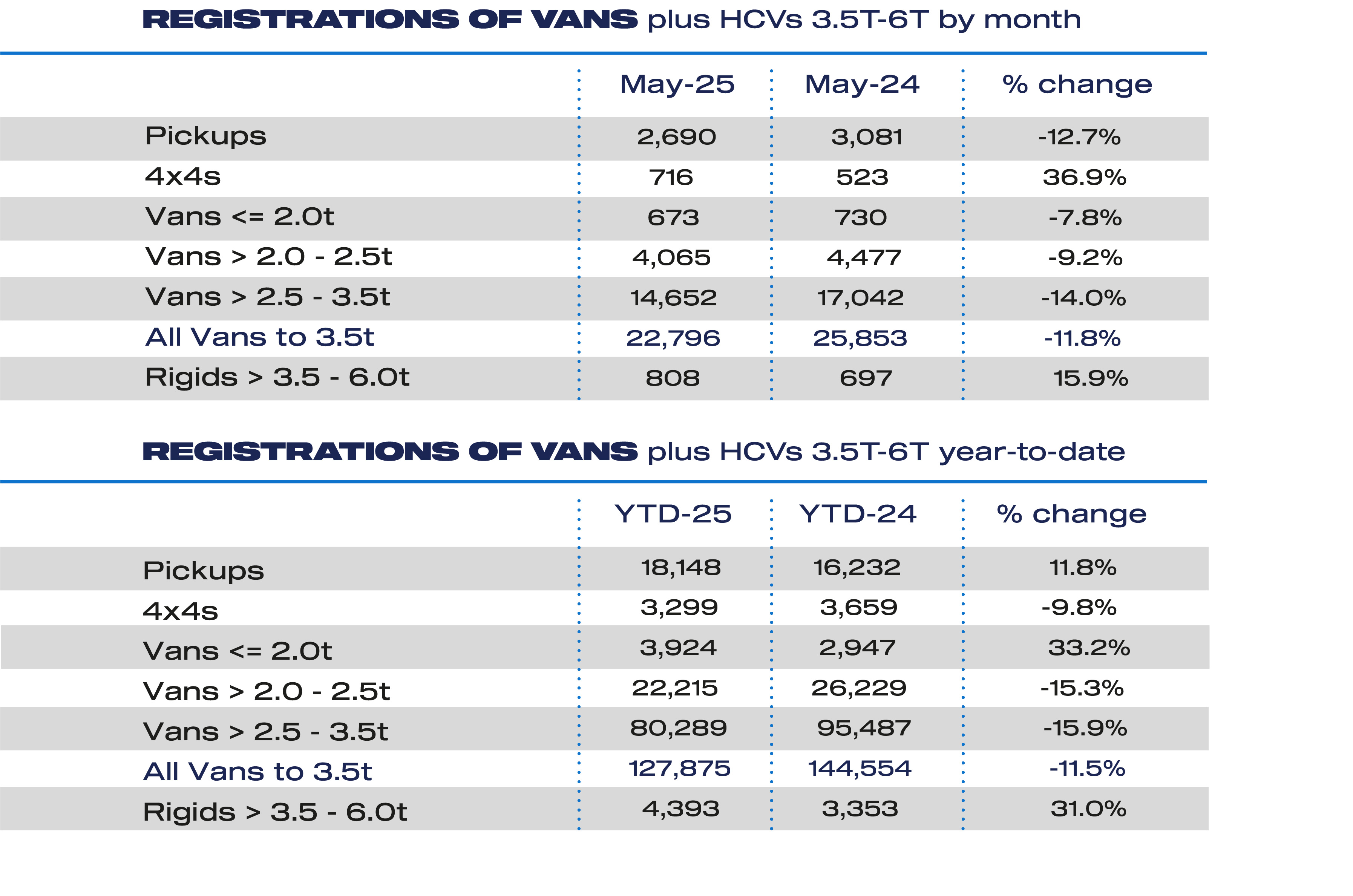

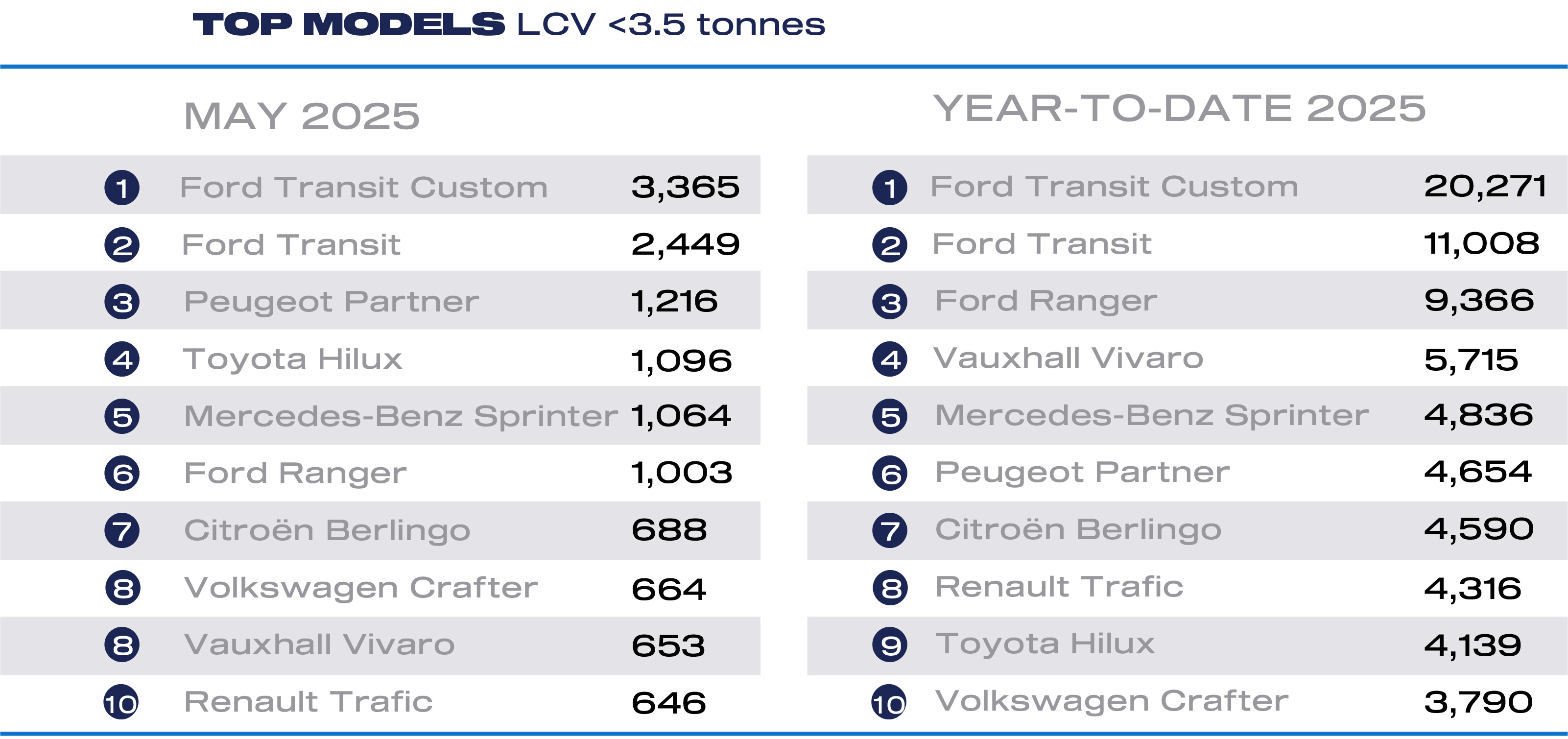

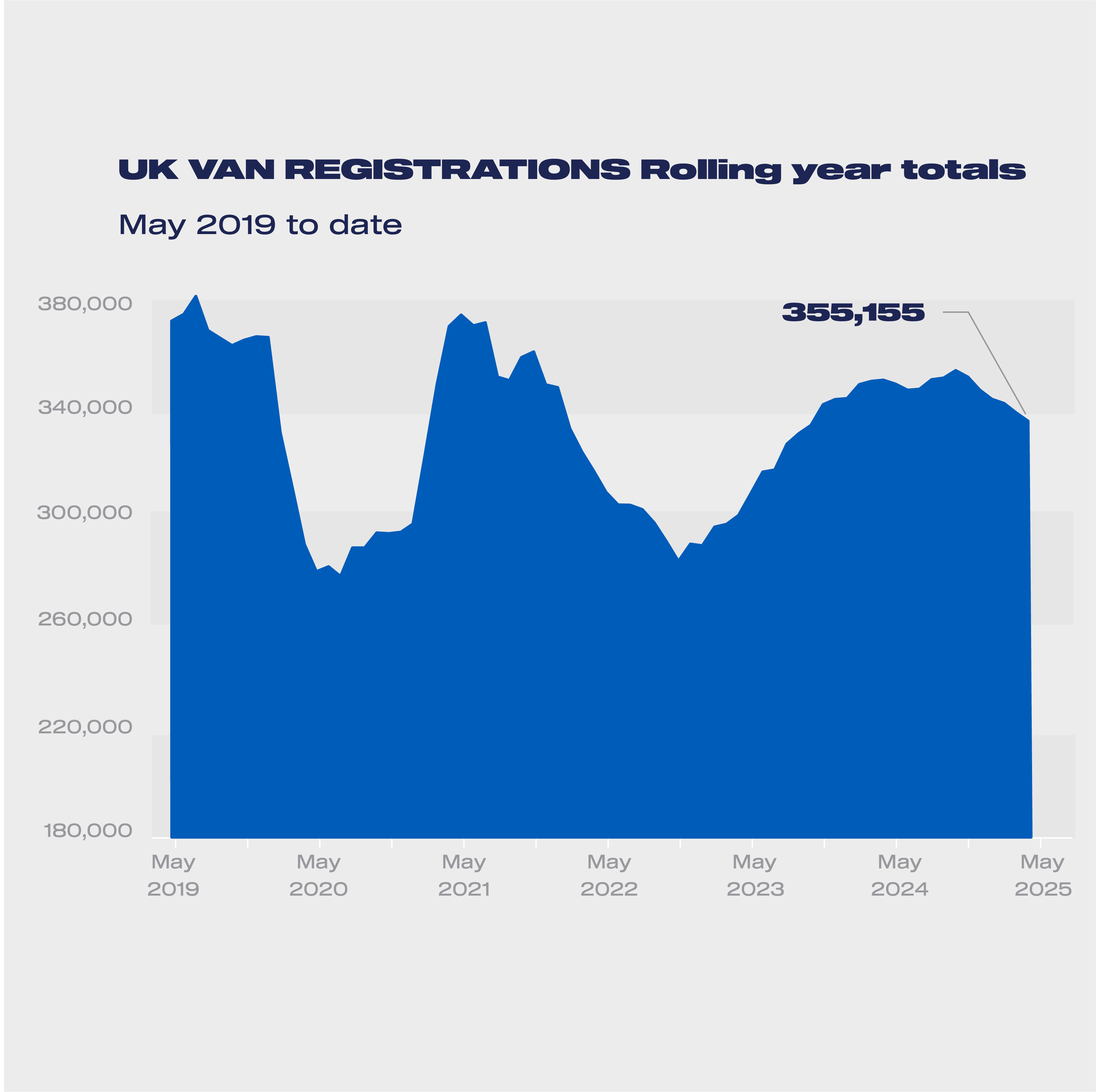

Thursday 5 June, 2025 The UK’s new light commercial vehicle (LCV) market fell by -11.8% in May with 22,796 vans, 4x4s and pick-ups joining the road, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The contraction marks the lowest May performance since 2022 and rounds off the sixth consecutive month of decline, as weak business confidence holds back fleet investment.1

Demand shrank for new vans of all sizes, with the largest models down -14.0% to 14,652 units, while deliveries of medium sized vans fell by -9.2% to 4,065 units and the smallest vans by -7.8% to 673. Only the new 4×4 segment saw growth, up 36.9% to 716 units. The pickup segment, meanwhile, declined by -12.7% to 2,690 registrations as April’s introduction of fiscal measures to treat double-cabs as cars for benefit in kind and capital allowance purposes began to bite.

The tax change is heaping additional costs on businesses in key sectors – such as farming, construction, utilities and sole trading – which depend on these operationally critical vehicles. Discouraging operators from placing new orders will keep more polluting vehicles on the road for longer and, counterproductively, reduce tax revenues given lower volumes. SMMT continues to urge government to postpone the change for at least one year to give industry and customers more time to prepare, especially given new lower and zero emitting vehicles entering the market.

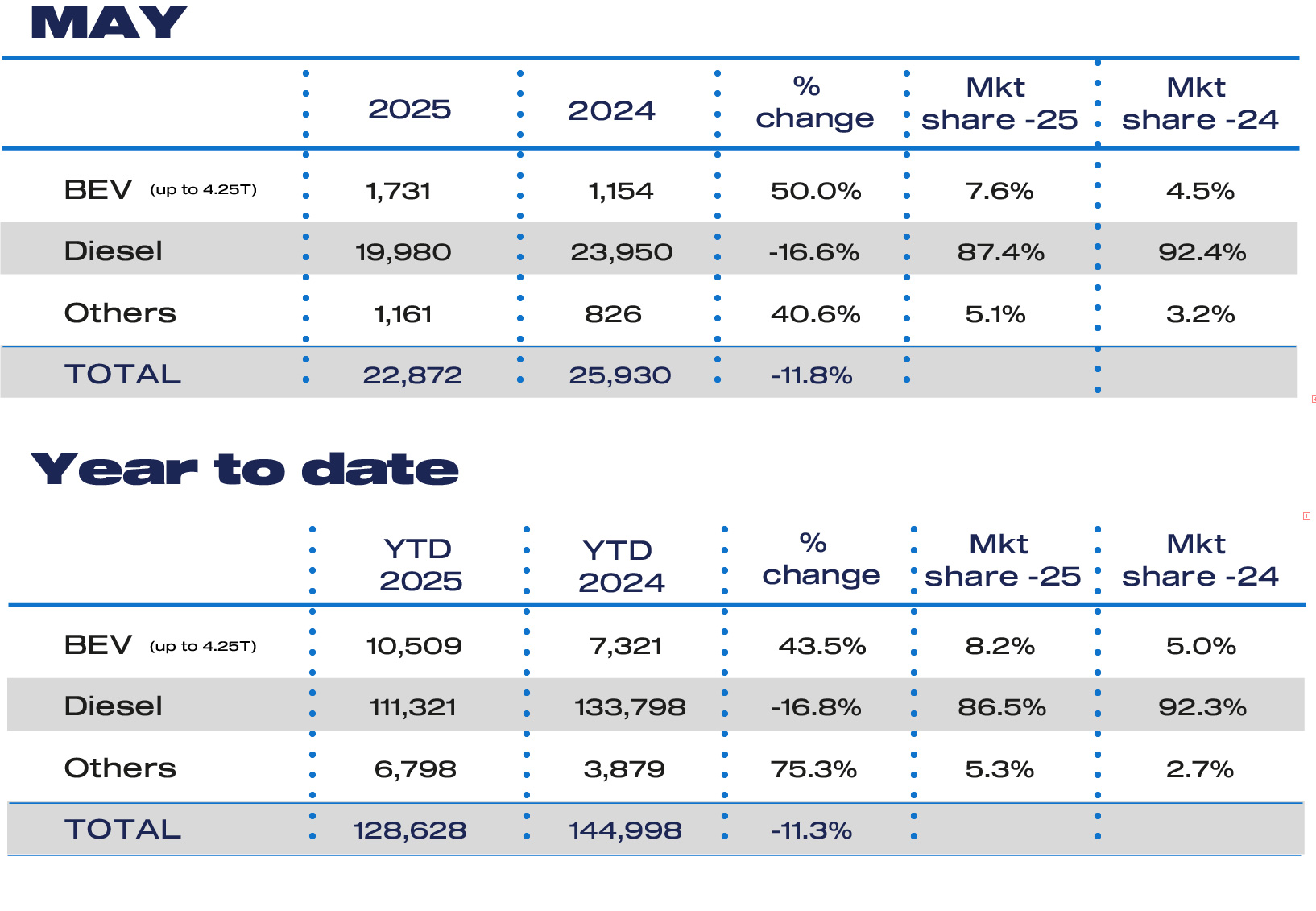

Manufacturers are making massive investments to decarbonise the market and demand for battery electric vans (BEVs) continues to grow, up 50.0% to 1,731 units in May – the seventh successive month of rising demand.2 Businesses can now choose from almost 40 BEV models that meet a wide range of use cases but, despite this, zero emission vans represented just 7.6% of the overall market in May and 8.2% in the year to date – half the 16% share mandated for 2025.

The Plug-in Van Grant continues to offer essential support for buyers, but rapid investment in LCV-suitable charging infrastructure – at public, depot and shared hub locations across the UK – is key to unlocking further decarbonisation. Preferential treatment for depot grid connections is also necessary, given the waiting time of up to 15 years – beyond the 2035 end of ICE sale date. Consistent and efficient implementation of local planning policy, meanwhile, will help streamline the fleet transition and give businesses greater confidence to plan for change.

Mike Hawes, SMMT Chief Executive, said, “Six months of declining new van demand reflects a tough economic environment and weak business confidence – and that won’t be helped by punitive taxes such as on double-cabs that will only restrict wider growth. Fleet renewal with the latest, cleanest models must be encouraged so it’s positive that zero emission van uptake is rising, but with market share at just half the mandated level, it’s clear we need action to drive that uptake faster. Accelerating LCV-centric and affordable chargepoint rollout is the bold next step that van operators and manufacturers need now.”