“The Volkswagen Group was on a solid track in 2025 – despite a challenging market environment. With around nine million vehicles delivered, our sales remain stable thanks to our attractive products across all brands and drive types. We have made good progress in comprehensively renewing our product range. Our new vehicles are receiving an excellent response and have won numerous awards. With more than 20 new models, we will continue our product offensive at full speed in 2026. These include further innovative vehicles from our model offensive in China and our Electric Urban Car Family. Entry-level e-mobility with top technology from Volkswagen, CUPRA, and Škoda – the next step on our path to becoming the global automotive tech driver.”

Oliver Blume, CEO Volkswagen Group

“Our attractive products were the basis for a solid delivery performance in 2025 – even under very challenging conditions. In particular, the intense competitive situation in China, as well as tariffs and the discontinuation of electric vehicle subsidies in the US have impacted our business. On the other hand, we have further expanded our strong position in Europe despite new competitors.

The same applies to South America, where we also gained market share. We are very pleased with our dynamic growth in all-electric vehicles. Their global deliveries rose by more than 30 per cent, and in Europe even by more than 60 per cent. With our new models across all drive types, we are meeting customer tastes and are well positioned for 2026.”

Marco Schubert, Member of the Group’s Extended Executive Committee for Sales

|

Key figures |

|

|

|

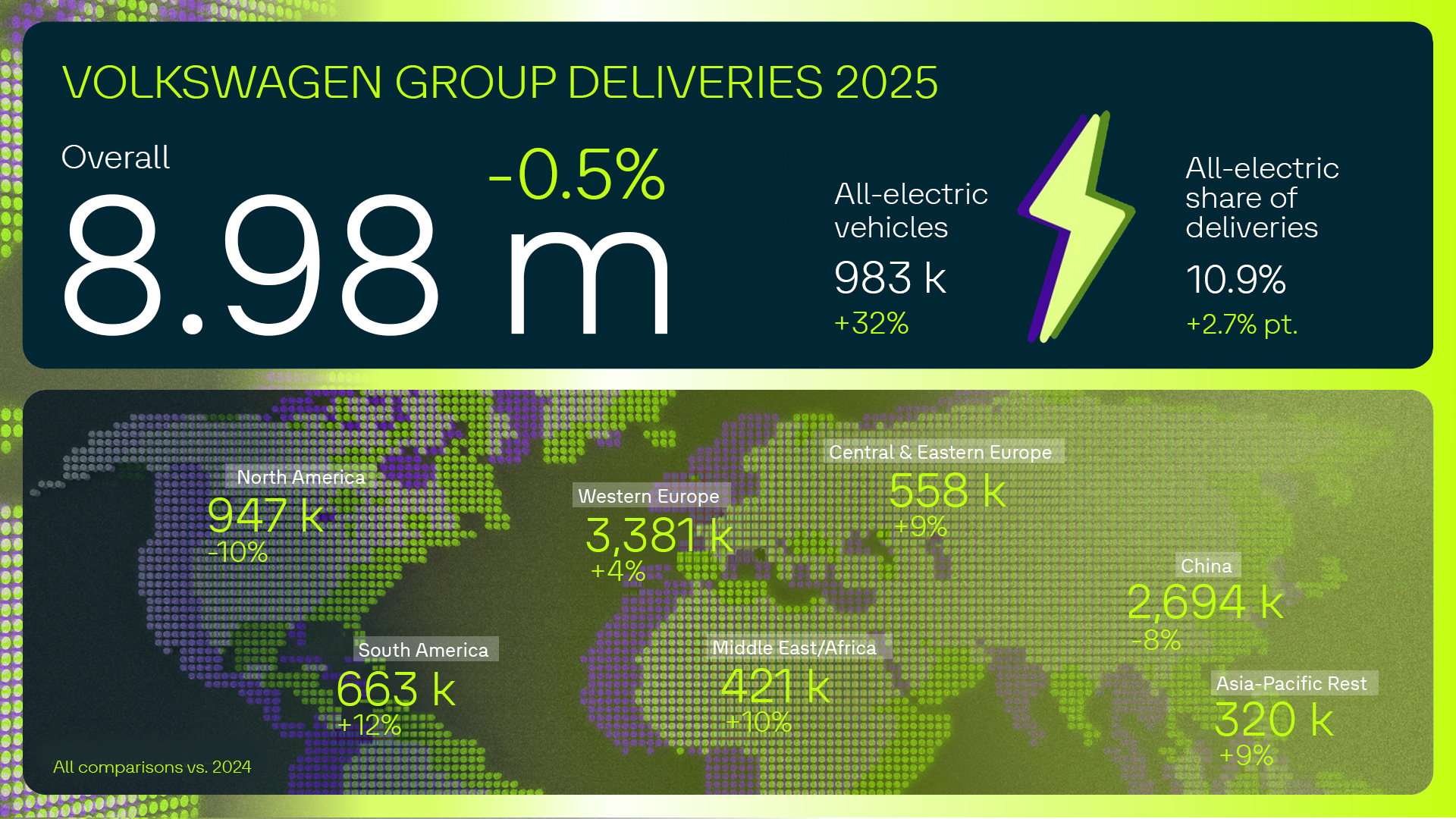

8.98 million vehicles delivered worldwide, down 0.5 per cent from the previous year (9.03 million vehicles) |

|

Significant growth in Europe (+4 per cent) and South America (+12 per cent) contrasts with expected declines due to challenging market conditions in North America (-10 per cent) and China (-8 per cent). Spotlight Europe: Market share expanded to a new high of around 25 per cent1 despite new competitors; VW T-Roc and VW Tiguan each ranked first in the two most important growth segments Spotlight South America: Deliveries increased to highest level since 2014 despite strong competitive pressure; successful new models such as the VW Tera, which attracted more than 56,000 customers in its first year, make an important contribution Spotlight China: Audi regains top spot in the premium segment after six years, Volkswagen (including Jetta) expands combustion engine market leadership |

|

983,100 vehicles worldwide: BEV deliveries up 32 per cent over the previous year (744,600 vehicles) |

|

Global BEV share of deliveries rose significantly year-on-year from 8 to 11 per cent; strong growth in Europe (+66 per cent) resulted in a further expansion of the BEV market leadership there (market share around 27 per cent1), five Group vehicles among the top 10 BEV models in Europe; significant growth also in the USA (+46 per cent); decline in China as planned (- 44 per cent) in preparation for the launch of new locally developed electric models |

|

BEV order intake in Europe1 up around 55 per cent on the previous year |

|

Drivers include new models such as the Škoda Elroq, Audi A6 e-tron, and Volkswagen “The New Transporter”; BEV order book in Europe rises by 21 per cent to more than 200,000 vehicles, BEV share of total order book is around 22 per cent; order intake across all drive types rises by around 13 per cent |

|

428,000 vehicles worldwide PHEV deliveries up around 58 year-on-year |

|

Vehicles with modern second-generation plug-in hybrid drives (PHEVs) and pure electric ranges of up to 143 km2 are enjoying increasing demand and are growing particularly strongly in Europe (+72 per cent) |

Development of core regions

|

Europe Deliveries in the region rose by 4.5 per cent to 3.94 million vehicles. Growth in Western Europe was 3.8 per cent, while in Central and Eastern Europe it was even higher at 9.0 per cent. In the home market of Germany, 5.6 per cent more vehicles were handed over to customers. |

|

North America The Volkswagen Group delivered 946,800 vehicles, 10.4 per cent fewer than in the previous year. The main reason for this was the development in the main market, the USA. In a challenging environment characterised by the tariff situation, the decline there was 13.6 per cent. |

|

South America With an increase of 11.6 per cent, South America is the fastest-growing region with a total of 663,000 vehicles delivered. In the core market of Brazil, growth amounted to 5.7 per cent. |

|

Asia-Pacific Deliveries in the region declined by 6.5 per cent to 3.01 million vehicles. This was mainly due to the continuing intense competitive situation in China, which led to an 8.0 per cent decline in deliveries in that market. |

|

Best-selling all-electric vehicles (BEV) Volkswagen ID.4/ID.5 163,400 Volkswagen ID.3 117,700 Škoda Elroq 95,300 Audi Q4 e-tron (including Sportback) 84,900 Audi Q6 e-tron (including Sportback) 84,400 Škoda Enyaq (including Coupé) 79,600 Volkswagen ID.7 (including Tourer) 79,500 Volkswagen ID. Buzz (including Cargo) 60,700 Porsche Macan 45,400 CUPRA Born 43,700 |

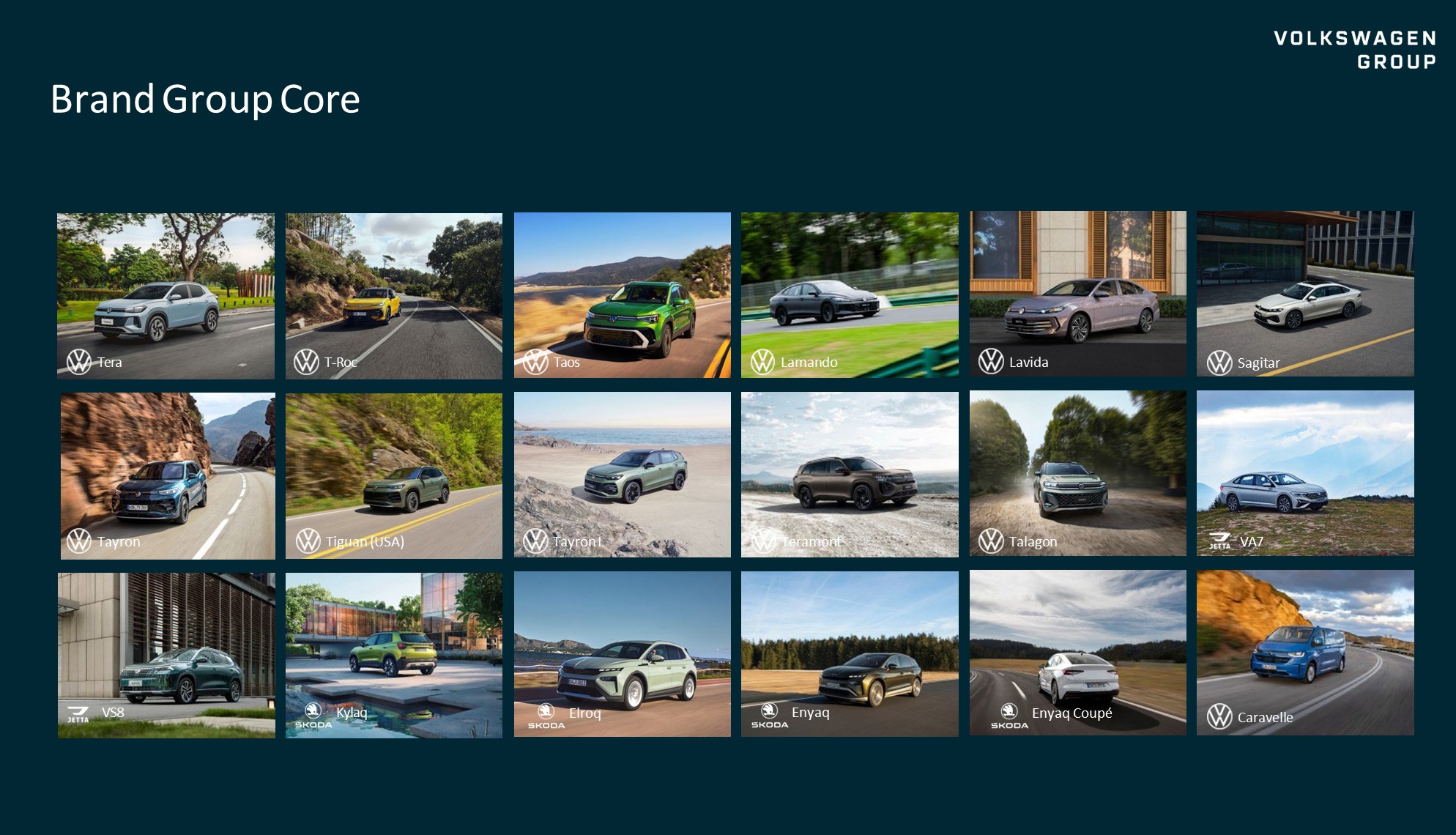

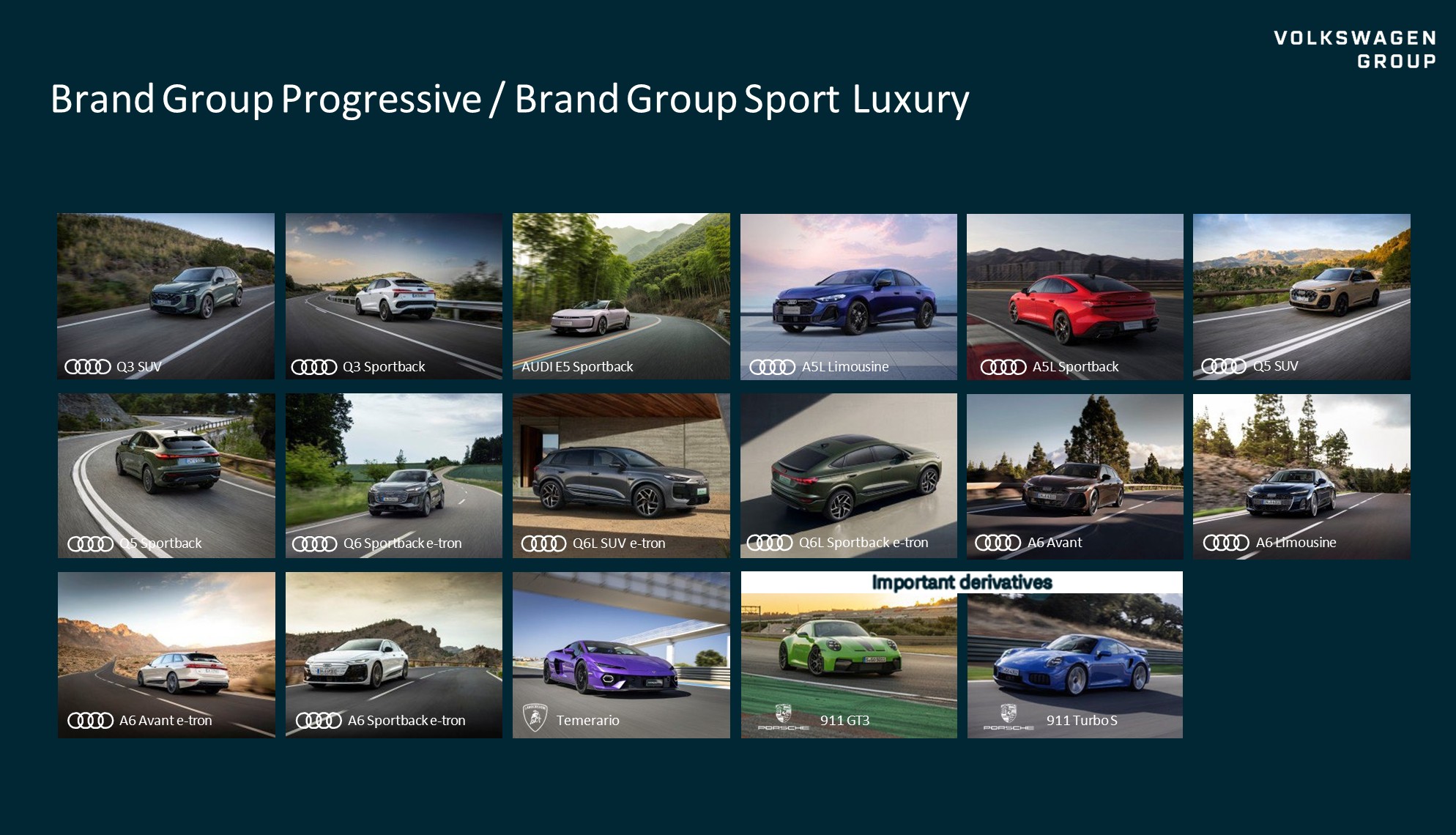

Selected passenger car model launches Volkswagen Group 2025

1) EU27 + Norway + Iceland + United Kingdom + Switzerland

2) Volkswagen Golf 1.5 eHybrid: Energy consumption weighted combined 15.6-14.6 kWh/100 km plus 0.3 l/100 km; fuel consumption with discharged battery combined: 5.3-5.0 l/100 km; CO2 emissions weighted combined 7-6 g/km; CO2 class weighted combined: B; CO2 class with discharged battery: D-C

2) Audi A3 Sportback TFSI E: Energy consumption weighted combined 16.6-14.6 kWh/100 km plus 0.4-0.3 l/100 km; fuel consumption with discharged battery combined: 5.4-4.9 l/100 km; CO2 emissions weighted combined 8-6 g/km; CO2 class weighted combined: B; CO2 class with discharged battery: D-C

Volkswagen Tera: This model is not available for sale in Europe

Volkswagen T-Roc 1.5 eTSI: Energy consumption combined 6.0–5.6 l/100 km; CO₂ emissions combined 136–128 g/km; CO₂ class: E–D

Volkswagen Taos: This model is not available for sale in Europe Volkswagen Lamando: This model is not available for sale in Europe Volkswagen Lavida: This model is not available for sale in Europe Volkswagen Sagitar: This model is not available for sale in Europe

Volkswagen Tayron 2.0 TSI: Energy consumption combined 8.5 l/100km; CO₂ emissions combined 193 g/km; CO₂ class: G

Volkswagen Tiguan (USA): This model is not available for sale in Europe Volkswagen Tayron L: This model is not available for sale in Europe Volkswagen Teramont: This model is not available for sale in Europe Volkswagen Talagon: This model is not available for sale in Europe Jetta VA7: This model is not available for sale in Europe

Jetta VS8: This model is not available for sale in Europe

Škoda Kylaq: This model is not available for sale in Europe

Škoda Enyaq: Energy consumption combined 16.9-14.9 kWh/100km; CO₂ emissions combined 0 g/km; CO₂ class A

Škoda Enyaq Coupé: Energy consumption combined 16.3-15.0 kWh/100km; CO₂ emissions combined 0 g/km; CO₂ class A

Volkswagen e-Caravelle Style: Energy consumption combined 24.7 kWh/100km; CO₂ emissions combined 0 g/km; CO₂ class A

Audi Q3 Sportback e-hybrid: Energy consumption weighted combined 15.1-14.0 kWh/100 km plus 2.2-1.7 l/100 km; fuel consumption with discharged battery combined: 6.7-6.0 l/100 km; CO2 emissions weighted combined 50-40 g/km; CO2 class weighted combined: B; CO2 class with discharged battery: E

AUDI E5 Sportback: This model is not available for sale in Europe Audi A5L Sedan: This model is not available for sale in Europe Audi A5L Sportback: This model is not available for sale in Europe Audi Q6L SUV e-tron: This model is not available for sale in Europe

Audi Q6L Sportback e-tron: This model is not available for sale in Europe

Lamborghini Temerario: Energy consumption weighted combined 4.3 kWh/100 km plus 11.2 l/100 km; fuel consumption with discharged battery combined: 14 l/100 km; CO2 emissions weighted combined 272 g/km; CO2 class weighted combined: G; CO2 class with discharged battery: G

Porsche 911 GT3: Energy consumption combined 13.8–13.7 l/100 km; CO₂ emissions combined 312–310 g/km; CO₂ class: G

Porsche 911 Turbo S: Energy consumption combined 11.8–11.6 l/100 km; CO₂ emissions combined 266–262 g/km; CO₂ class: G

Deliveries Volkswagen Group – All drive types

|

Deliveries to customers by market |

Oct. – Dec. 2025 |

Oct. – Dec. 2024 |

Delta (%) |

Jan. – Dec. 2025 |

Jan. – Dec. 2024 |

Delta (%) |

|

Western Europe |

879,800 |

833,200 |

+5.6 |

3,381,100 |

3,257,800 |

+3.8 |

|

Central and Eastern Europe |

151,800 |

143,300 |

+5.9 |

557,900 |

512,000 |

+9.0 |

|

North America |

238,000 |

288,000 |

-17.4 |

946,800 |

1,057,000 |

-10.4 |

|

South America |

181,300 |

175,200 |

+3.5 |

663,000 |

594,300 |

+11.6 |

|

China |

719,800 |

871,500 |

-17.4 |

2,693,800 |

2,928,100 |

-8.0 |

|

Rest of Asia-Pacific |

86,500 |

80,400 |

+7.5 |

320,400 |

295,200 |

+8.5 |

|

Middle East/Africa |

122,700 |

110,600 |

+10.9 |

420,800 |

382,400 |

+10.1 |

|

World |

2,379,800 |

2,502,300 |

-4.9 |

8,983,900 |

9,026,700 |

-0.5 |

|

Deliveries to customers by brand |

Oct. – Dec. 2025 |

Oct. – Dec. 2024 |

Delta (%) |

Jan. – Dec. 2025 |

Jan. – Dec. 2024 |

Delta (%) |

|

Brand Group Core |

1,778,600 |

1,887,600 |

-5.8 |

6,754,500 |

6,689,200 |

+1.0 |

|

Volkswagen Passenger Cars |

1,238,100 |

1,399,400 |

-11.5 |

4,730,600 |

4,796,200 |

-1.4 |

|

Škoda |

278,200 |

255,300 |

+9.0 |

1,043,900 |

926,600 |

+12.7 |

|

SEAT/CUPRA |

146,800 |

136,100 |

+7.9 |

586,300 |

558,200 |

+5.0 |

|

Volkswagen Commercial Vehicles |

115,500 |

96,800 |

+19.3 |

393,700 |

408,300 |

-3.6 |

|

Brand Group Progressive |

453,300 |

441,200 |

+2.7 |

1,644,400 |

1,692,500 |

-2.8 |

|

Audi |

447,800 |

435,600 |

+2.8 |

1,623,600 |

1,671,200 |

-2.9 |

|

Bentley |

2,900 |

3,300 |

-11.3 |

10,100 |

10,600 |

-4.8 |

|

Lamborghini |

2,600 |

2,300 |

+14.5 |

10,700 |

10,700 |

+0.6 |

|

Brand Group Sport Luxury |

66,900 |

84,700 |

-21.0 |

279,400 |

310,700 |

-10.1 |

|

Porsche |

66,900 |

84,700 |

-21.0 |

279,400 |

310,700 |

-10.1 |

|

Brand Group Trucks / TRATON |

81,000 |

88,800 |

-8.8 |

305,600 |

334,200 |

-8.6 |

|

MAN |

30,000 |

26,800 |

+11.9 |

101,600 |

95,700 |

+6.2 |

|

Volkswagen Truck & Bus |

9,500 |

10,100 |

-6.0 |

46,100 |

45,800 |

+0.6 |

|

Scania |

25,700 |

28,100 |

-8.6 |

94,100 |

102,100 |

-7.9 |

|

International |

15,800 |

23,800 |

-33.7 |

63,700 |

90,600 |

-29.6 |

|

Volkswagen Group (total) |

2,379,800 |

2,502,300 |

-4.9 |

8,983,900 |

9,026,700 |

-0.5 |

Per centage changes are based on unrounded figures

Volkswagen Group deliveries – all-electric vehicles (BEV)

|

Deliveries to customers by market |

Oct. – Dec. 2025 |

Oct. – Dec. 2024 |

Delta (%) |

Jan. – Dec. 2025 |

Jan. – Dec. 2024 |

Delta (%) |

|

Europe |

220,300 |

154,400 |

+42.7 |

742,800 |

447,600 |

+65.9 |

|

USA |

3,200 |

12,300 |

-73.6 |

72,000 |

49,400 |

+45.7 |

|

China |

30,300 |

59,300 |

-48.8 |

115,500 |

207,400 |

-44.3 |

|

Rest of the world |

11,700 |

12,100 |

-2.9 |

52,900 |

40,100 |

+31.7 |

|

World |

265,600 |

238,000 |

+11.6 |

983,100 |

744,600 |

+32.0 |

|

BEV share of global deliveries (%) |

11.2 |

9.5 |

+1.6 pt. |

10.9 |

8.2 |

+2.7 pt. |

|

Deliveries to customers by brand |

Oct. – Dec. 2025 |

Oct. – Dec. 2024 |

Delta (%) |

Jan. – Dec. 2025 |

Jan. – Dec. 2024 |

Delta (%) |

|

Brand Group Core |

192,000 |

166,000 |

+15.6 |

695,200 |

539,200 |

+28.9 |

|

Volkswagen Passenger Cars |

94,300 |

111,700 |

-15.5 |

382,000 |

382,900 |

-0.2 |

|

Škoda |

56,300 |

28,800 |

+95.7 |

174,900 |

79,600 |

+119.8 |

|

SEAT/CUPRA |

22,400 |

16,900 |

+32.5 |

79,700 |

48,000 |

+65.9 |

|

Volkswagen Commercial vehicles |

19,000 |

8,700 |

+117.9 |

58,600 |

28,800 |

+103.4 |

|

Brand Group Progressive |

59,600 |

48,700 |

+22.4 |

223,000 |

164,500 |

+35.6 |

|

Audi |

59,600 |

48,700 |

+22.4 |

223,000 |

164,500 |

+35.6 |

|

Bentley |

– |

– |

– |

– |

– |

– |

|

Lamborghini |

– |

– |

– |

– |

– |

– |

|

Brand Group Sports Luxury |

12,800 |

22,700 |

-43.5 |

61,700 |

39,100 |

+57.8 |

|

Porsche |

12,800 |

22,700 |

-43.5 |

61,700 |

39,100 |

+57.8 |

|

Brand Group Trucks / TRATON |

1,200 |

60 |

+91.7 |

3,200 |

1,700 |

+85.8 |

|

MAN |

880 |

350 |

+150.4 |

1,970 |

740 |

+167.8 |

|

Volkswagen Truck & Bus |

10 |

20 |

-70.8 |

60 |

120 |

-49.2 |

|

Scania |

220 |

80 |

+188.3 |

600 |

270 |

+126.3 |

|

International |

50 |

150 |

-64.9 |

590 |

610 |

-3.3 |

|

Volkswagen Group (total) |

265,600 |

238,000 |

+11.6 |

983,100 |

744,600 |

+32.0 |

Per centage changes are based on unrounded figures