- Fleets drive new car market growth in May as total registrations rise 1.6% year on year.

- BEV registrations rise by more than a quarter, but still below mandated levels.

- Sector calls for VAT cuts on EV purchases and home charging plus VED reform.

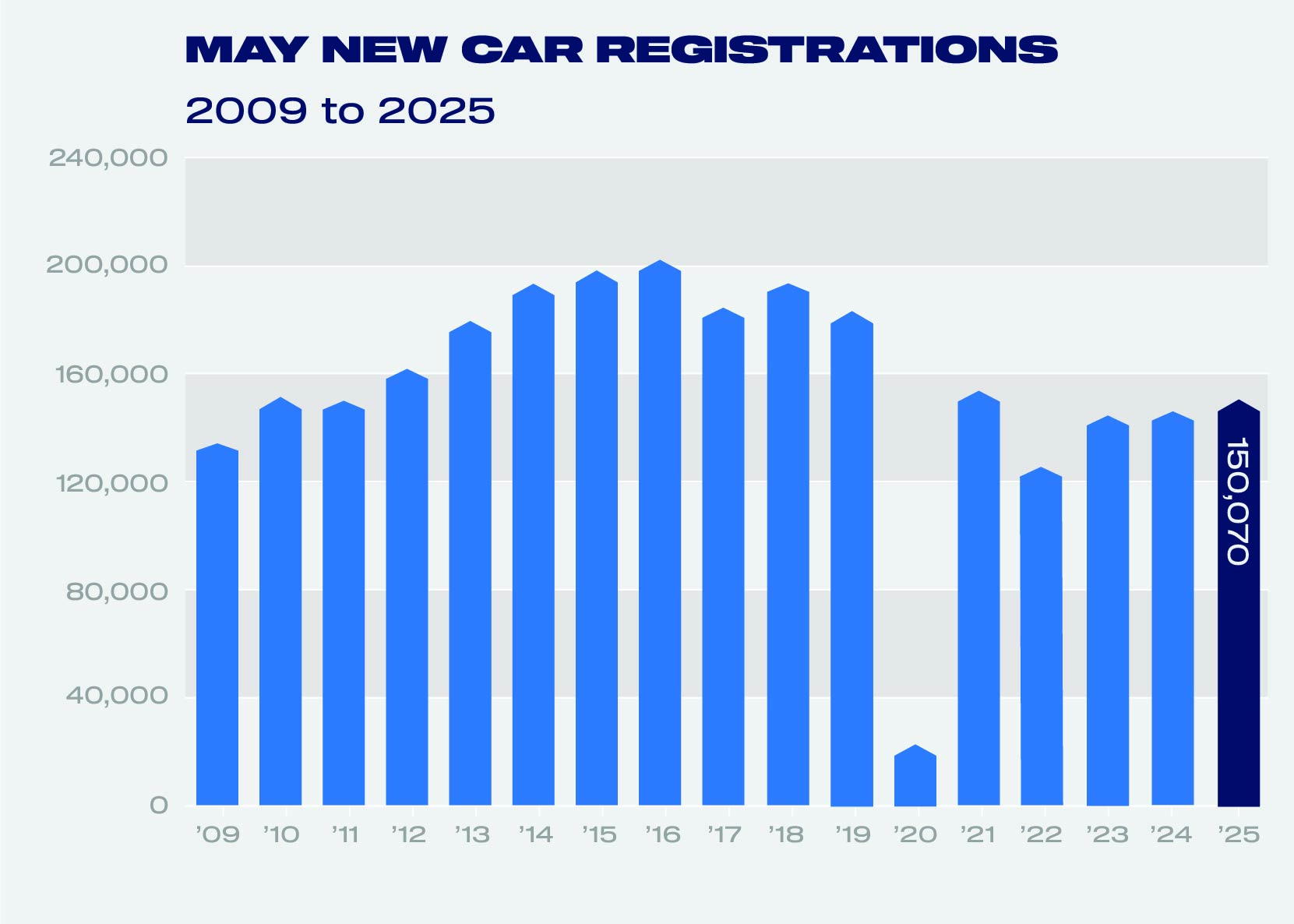

Thursday 5 June, 2025 The UK’s new car market returned to growth in May, as registrations rose 1.6% to 150,070 units, according to the latest data published today by the Society of Motor Manufacturers and Traders (SMMT). It was the best May performance since 2021, but still -18.3% lower than in pre-pandemic 2019 and only the second month of growth this year, reflecting brittle consumer confidence and economic turbulence.1

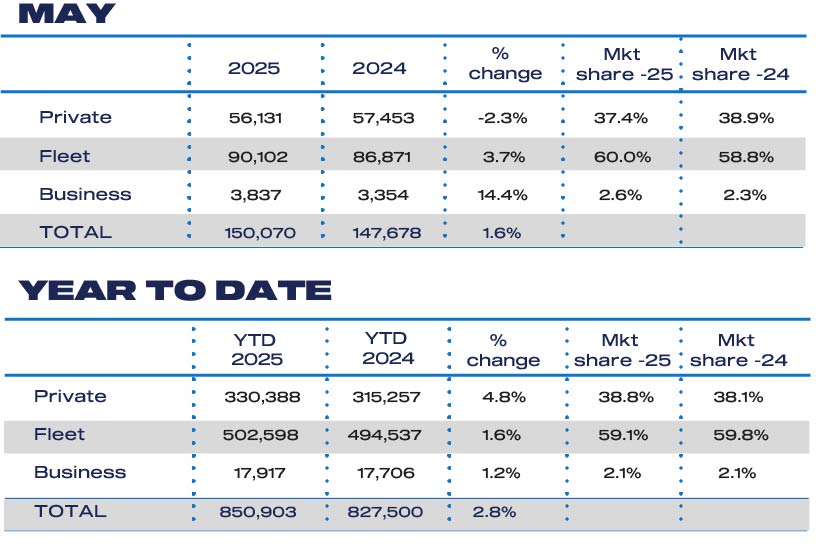

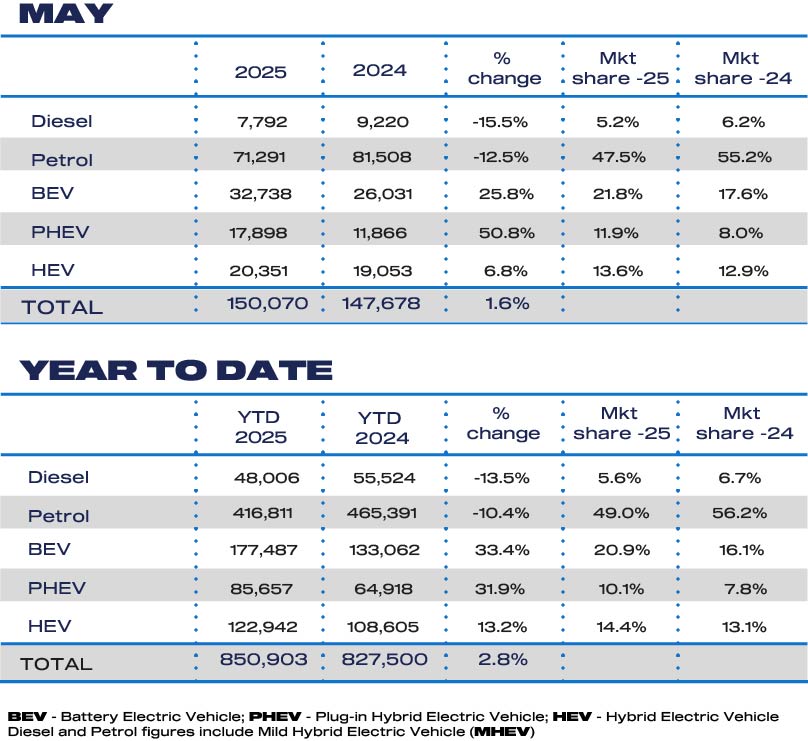

Fleets and businesses drove the growth, up 3.7% and 14.4% respectively and responsible for 62.6% of registrations, while interest from private buyers fell for the second consecutive month, down -2.3%. There were double digit declines in deliveries of both petrol and diesel cars – down -12.5% and -15.5% – while demand for the latest electrified models increased dramatically to take a combined 47.3% market share.

Uptake of hybrid electric vehicles (HEVs) grew by 6.8% to 20,351 units, while plug-in hybrid electric vehicles (PHEVs) were up more than half (50.8%) to 17,898. Registrations of battery electric vehicles (BEVs), meanwhile, rose by 25.8%, accounting for 21.8% of the market as manufacturers continued to support sales with attractive incentives.

Despite this, BEV registrations year-to-date have only reached 20.9% market share – still seven percentage points off the 28% mandated by regulation. Moreover, significant discounting is still ongoing despite new model introductions and increasingly affordable offerings. While recent adjustments to the ZEV Mandate were welcome, the current market situation is unsustainable for a sector already facing multiple cost pressures.

Manufacturers are investing billions to deliver zero emission mobility for all, and consumers are responding but not in the volumes needed – so industry calls on government to match this commitment with fiscal incentives. Halving VAT on new EV purchases would put 267,000 additional new EVs – rather than fossil fuel vehicles – on the road in the next three years and drive down CO2 emissions by six million tonnes a year. Removing EVs from the VED Expensive Car Supplement, meanwhile, and equalising VAT paid on public charging to that levied at home would send a signal that now is the time to switch.

Mike Hawes, SMMT Chief Executive, said, “A return to growth for new car registrations in May is welcome but manufacturer discounting on new products continues to underpin the market, notably for electric vehicles. This cannot be sustained indefinitely as it undermines the ability of companies to invest in new product development – investments which are integral to the decarbonisation of all road transport. Next week’s Spending Review is the opportunity for government to double down on its commitments to Net Zero by driving demand through fiscal measures that boost the market and shore up our competitiveness.”

Latest data shows the breadth of vehicle powertrain choice now available, with sustained investment by manufacturers into product development, meaning car buyers can choose from more than 135 BEVs – up from 106 last year – while there are also just over 100 PHEVs and nearly 50 HEVs.2 The average BEV is capable of driving almost 300 miles on a single charge and, for those keen to cut their emissions but not quite ready to go fully electric, the average PHEV electric-only range is just under 50 miles. Some PHEVs offer as much as 88 miles of zero emission motoring, while HEVs can also travel in electric mode with zero emissions at low speeds.

Notes to editors

1: May 2021 new car registrations 156,737 units, May 2019 was 183,724 units

2: SMMT analysis of new car registration data

About SMMT and the UK automotive industry

The Society of Motor Manufacturers and Traders (SMMT) is one of the largest and most influential trade associations, representing the automotive industry in the UK.

The automotive industry is a vital part of the UK economy, integral to growth, the delivery of net zero and the UK as a global trade hub. It contributes £93 billion turnover and £22 billion value added to the UK economy, and invests around £4 billion each year in R&D. With 198,000 people employed directly in manufacturing and some 813,000 across the wider automotive industry. Many of these automotive manufacturing jobs are outside London and the South-East, with wages that are around 13% higher than the UK average. The sector accounts for 13.9% of total UK exports of goods with more than 140 countries importing UK produced vehicles, generating £115 billion of trade in total automotive imports and exports.

The UK manufactures almost every type of vehicle, from cars, to vans, taxis, trucks, buses and coaches, as well as specialist and off-highway vehicles, supported by more than 2,500 component providers and some of the world’s most skilled engineers. In addition, the sector has vibrant aftermarket and remanufacturing industries. The automotive industry also supports jobs in other key sectors – including advertising, chemicals, finance, logistics and steel.

More detail on UK Automotive available in SMMT’s Motor Industry Facts publication at https://www.smmt.co.uk/reports/smmt-motor-industry-facts/